Onchain FX

How to Make Foreign Exchange More Fair

Foreign Exchange (FX) is the largest market in the world: the Bank for International Settlements estimated that the daily average in 2022 was around $7.5 Trillion.

However, popular services like Mama charge 10% for sending money between South Africa and Zimbabwe and they quote you R18.24 for each dollar, while the Google exchange rate (which is not always accurate) is R17.881. Sending money across other direct borders like Kenya and Tanzania (even though both have MPesa!) can cost up to 36%.

Imagine there was a way to give ordinary people like you and me access to similar rates as institutional trading desks get, without extractive fees? Imagine how much money could actually get to its intended destination, rather than being siphoned off in inefficient and unfair markets?

Bringing FX markets onchain could help us achieve this, if done well. This is not a new claim: read a 2023 academic paper from Uniswap and Circle here.

That said, don’t believe all you read: blockchains don’t settle instantly; “immutability” is an economic tradeoff not a physical guarantee; and the transparent, public nature of transactions some tout as a benefit can be asymmetrically costly.

However, they do excel at providing collusion- and censorship-resistant, global environments in which actors with competing economic incentives can still coordinate. In the context of FX, this means we can set three goals which would make FX “better” if it were done onchain:

credibly neutral markets where no-one can collude to fix rates;

markets that settle everyone at very similar prices regardless of sophistication;

markets that route trades intelligently and transparently, finding the cheapest execution paths and sharing any profits with users, not intermediaries.

Why Does This Matter?

The size of the market itself is indicative of the impact any gains in efficiency and fairness would have. What is “fair”, though? Firstly, it certainly means that no-one, or no small group, can collude to fix rates to their benefit. This is exactly what happened with LIBOR.

Any market we design should be resistant to such behaviour not just by virtue of post-facto legal battles, but a priori by virtue of how trades are created, communicated, and settled.

Secondly, “fair” probably means that the maximum payoff for any actor should not diverge significantly from the average. Removing centralized intermediaries helps achieve this, though there is more nuance we will consider in what follows.

Just removing the ability for anyone to fix rates and giving everyone very similar rates are already meaningful improvements to FX market structure.

Now, if you buy the case the USD stablecoins serve a need and are here to stay for the next decade, then onchain FX begins to make more sense. If you also buy the case that local stablecoins help maintain monetary sovereignty, ease payments within countries, and can help intra-country trade between emerging economies experiencing dollar shortages, then onchain FX really makes sense. This is because onchain FX markets not only resist rate fixing and offer everyone the same rate, they route trades more efficiently than current markets can.

Programmable Money

One level deeper: FX is one of the most basic ways we can leverage programmable money. Programmability means that you can associate specific conditions with any FX trade you make and that any trade (regardless of how it is programmed) can be routed intelligently and transparently: meaning that you can always see who settled it, at what rate, and how any profits from the trade were distributed.

What kind of conditions?

time (only trade between 9am and 5pm WAT),

counterparty (only trade with non-OFAC-sanctioned addresses),

volume (only trade if volume > $10m),

limit orders (only trade KES <> USD if KES >= 0.008 USD),

or more exotic conditions like:

only trade KES <> USD iff USD <> CNY shifts by 10 basis points.

And this is just the tip of the iceberg2.

Consider that trading between Kenyan Shillings and Nigerian Naira in traditional markets means going through USD. There is a good reason for this: liquidity. The KES <> USD and NGN <> USD markets are much more liquid than KES <> NGN, and so going through USD gets you better rates, even when you account for the fees you have to pay for the extra hops.

Programmable conditions and intelligent routing mean that, when it makes sense and meets your specific requirements, your trade can be routed through a different pair, or even traded directly, if the market is in a state where that results in a better outcome for each participant.

How To Make It Happen

Because the money moving in onchain FX markets is programmable, there is a computational universe of ways to enact such trades. This section is therefore not exhaustive: it will just describe two overarching methods for achieving our stated goals, with a few examples of each.

AMMs

Automated Market Makers (AMMs) like Uniswap discover the price of one asset relative to another by virtue of their liquidity ratio. This is a novel, transparent, and (arguably) more fair way of handling exchange. The tradeoffs are multiple, though.

In return for guaranteed settlement with no counterparty risk, we get less efficient use of capital and Loss-Versus-Rebalancing (LVR). Prices only update once every ~12seconds on Ethereum, but are discovered continuously on centralized exchanges, which creates significant arbitrage opportunities. If you decrease block time–even to ~250ms like Solana–this still happens, just faster. It is a necessary result of discrete block times. It can be mitigated, but not removed if this is the manner in which markets are made.

Lots of people have therefore asked if it is possible to use prices from other sources onchain (in a credibly neutral way), rather than letting the ratio of collateral determine them. Bancor V2 Dynamic Market Makers and DODO’s Proactive Market Maker are good examples of different ways of trying to navigate this particular trade-off space3. Uniswap v4 hooks also include new ways of integrating oracles.

Mento’s Fixed Price Market Makers (FPMMs) are another alternative. On the surface, these are relatively simple: use a system of oracles to set the price for a given pair, implement numerous checks to ensure that that price does not deviate too far from reference rates block-by-block, and automatically rebalance pools in which one-sided trading is happening, with some incentives for doing so.

In the trading pool itself, there are no complex mechanisms, no price curves, no LVR; yet settlement is fast and guaranteed. This is easier for traditional FX traders to understand. It’s attractive, not just because of quick, guaranteed settlement, but also because–with easy access to multiple currencies–you can essentially write your own Forward Exchange Contracts (or other kinds of Futures) without having to go to a bank. This means you can create cheaper, more dynamic hedges, with less counterparty risk (because banks are counterparties too).

So what is the counterparty risk here, exactly? It depends on how prices are set, and by whom.

Price Discovery

The “oracle problem” has haunted cryptocurrency projects for some time, but we think there are interesting solutions, some of which are in production as open source protocols like Chronicle. This means that the first people to create a legitimate FPMM with a resilient oracle system such that prices are set in a transparent, credibly neutral manner may capture a large part of the nascent onchain FX market.

How big is that market?

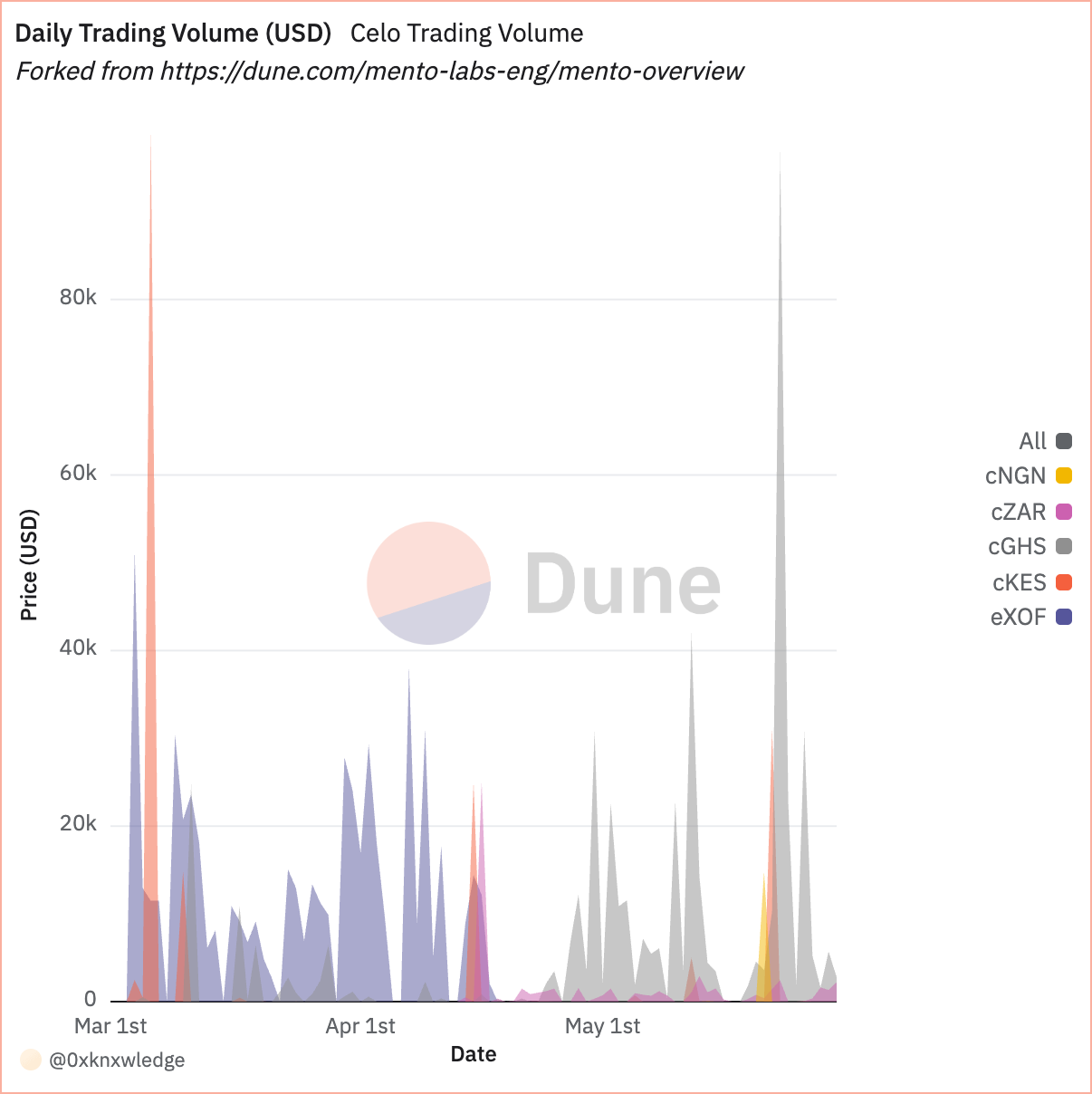

Daily trading volumes–especially for African currencies–remain very low at the moment. Other networks actively targeting emerging markets, like Stellar, produce fairly similar metrics. The opportunity remains up for the taking.

Even with the low liquidity above, FPMMs execute trades at prices that match the “real world” reference rates, they remove LVR without introducing another intermediary, and they provide a way of bridging onchain and offchain markets that otherwise operate in quite distinct ways.

There is the additional problem, though. Is the rate for a volatile currency like the Naira the Central Bank quoted rate, the open market rate, or somewhere between? Are prices really discovered onchain, offchain, or some mix of the two?

In practice, Uniswap and other successful Decentralized Exchanges (DEXes) have shown that onchain discovery is difficult because prices are updated discretely each block, whereas they change continuously offchain. However, these DEXes are attracting increasingly significant amounts of liquidity; the prices they discover cannot be manipulated (without significant financial risk); and the prices are the same for all participants (especially with the advent of private RPCs).

Most importantly, the prices are “always-on” and so do not suffer from the same kinds of risks that arise when markets close4.

FPMMs that are open to any liquidity provider, that programmatically ensure no manipulation and thereby provide the same price for everyone will likely play a significant role in the future of onchain FX. As more local stablecoins get created, FPMMs will also be able to offer more pairs, and to route trades between them all more efficiently, while retaining the same basic guarantees for all parties.

Resilience to price manipulation translates directly into an ability to scale.

RFQs

Prices that cannot be manipulated attend directly to our first two goals, but we haven’t yet discussed how to route trades intelligently and transparently, finding the cheapest execution paths and sharing profits according to some pre-agreed program. This goal would seem strange to a traditional market convenor, because they don’t have programmable money to work with.

The first people to think about how to route onchain trades at scale were 0x. 0x v3 enables market makers to post offchain quotes that takers can fill cheaply onchain. This has blossomed into a whole industry of different kinds of Request-For-Quote (RFQ) systems, which has had a big impact on how we transact onchain, right from trading in various applications all the way down to how blocks themselves get built.

0x v3 guarantees tight spreads and atomic, trustless filling. However, it requires market makers to stay online to sign quotes; it doesn't aggregate liquidity across market makers unless routed via a separate aggregator; and it isn’t optimized for MEV (which was still a new thing in 2020).

CoW Swap took the work done at 0x and extended it. Traders sign “intents” offchain, and “solvers” compete for the right to fill them in batch auctions, rather than on an order by order basis. These solvers compete to match orderflow, aggregate liquidity, and minimize slippage, thereby acting like MEV searchers. CoW Swap is better at aggregating fragmented liquidity and crossing flows, and it enables anyone to be a solver. However, it is less gas-efficient than 0x and latency with batch auctions is less predictable.

There’s also 1Inch Fusion, Paraswap, UniswapX, and Blur (RFQ system for NFTs), to name a few. There is a move towards generalized intents for everything from trading (web applications, Telegram bots and everything in between) to block production. The same pattern is being applied in interoperability work across most Ethereum L2s.

As you can see from these links, one of the key features is that solvers, searchers, and fulfillers refund part of the profits they make with users.

This is unprecedented, because it is impossible without programmable money.

Similar RFQ systems can be constructed for FX, and we’re already seeing some. A decentralized network of solvers, all competing to settle any trade at the best price, with the lowest slippage, while arb’ing across multiple chains and venues is also a really positive environment in which to implement better and more fair FX. Whether this can be made legible enough to traditional FX desks and financial institutions remains to be seen.

Summing Up

With FPMMS, we rely on the quality of the oracle network to provide accurate prices, in a credibly neutral and transparent manner. With RFQs, we rely on the quality of the solver network to settle trades quickly and optimally. Both of these can be made competitive, and incentivised so that the dominant strategy is to settle at the true price, such that neither solution introduces new counterparty risk.

RFQs are good at aggregating fragmented liquidity and crossing flows, and sharing profits from doing so back to end users. FPMMs don’t need a great deal of liquidity to function correctly, and can also be structured to share profits with users (via a token). They make different trade-offs in pursuit of the same goals we stated above5.

For ordinary users in Africa (and all emerging markets) the implications of onchain FX markets are simple, but profound:

More of our money gets to its intended recipients, more quickly.

No more different prices for institutional FX desks vs small retail customers. We all can access and use the same markets.

If someone earns from settling our trades, we see a portion of that profit, rather than watching fees escalate in corridors owned by one or two large institutions.

Lower capital requirements and markets which do not create unfair arbitrage opportunities, or losses for liquidity providers, is a potent combination. We think Mento has the best chance of establishing FPMMs as a legitimate solution for onchain FX and have therefore invested in them: more on the team and specifics in a follow-up post.

The programmable nature of the money now being exchanged means that the scope for innovation is huge and, for African builders, opportunities abound. Mento (and other teams like them) cannot solve all outstanding issues discussed above, nor serve the entire FX market. We need:

more, and more accurate, oracles

local stablecoins, and not only those backed by volatile fiat reserves

merchant networks that accept those stablecoins

keepers, solvers, fulfillers

relays on the continent and better block building algorithms

research into auction mechanisms and their properties in different production conditions like high latency intra-Africa trade

AI agents, and other intelligent algorithms, to operate in less liquid markets and keep them in line with global standards, even when big institutional desks have closed or taken holidays.

FX is such a large market that we’ll continue looking at other players in this rapidly developing space. RFQs definitely have a role to play in all this, and we’re excited to one day see traditional FX institutions celebrating returning $1M to their customers in the same way that Ethereum-based Telegram bots do today.

As of 6 Aug 2025, 11:15am CAT. What’s not shown on the Mama site is that you can send Rands to Zimbabwe (where ZAR is accepted and used), for which you are charged 15% (because there is no spread). The Uniswap and Circle paper cited a few sentences later reads, “Our estimates based on on-chain data and existing on-ramps suggest that DeFi can reduce remittance costs by as much as 80 percent relative to banks and money transmitters relying on traditional payment systems.”

Uniswap v4 hooks enable variable fee structures, the integration of oracle mechanisms, and policy checks required by regulated entities providing liquidity onchain, among many other programmable conditions. The limit is your imagination and creativity, not a given institution’s ruleset.

An interesting historical note on Bancor: one of their early advisers was Bernard Lietaer, who developed the first in-depth research on “floating exchange rates” a year before President Nixon took the United States off the gold standard and initiated a worldwide shift to floating exchange. We invite you to read some of his more speculative work if this history interests you.

See this BIS paper for a description of the BIS paper that studied a flash crash in the Sterling that occurred in early-morning Asian trading while other exchanges were still closed.

Both are strictly better than p2p escrows, which have been used since early on, because they do not require dispute resolution mechanisms, nor do they rely on any single party convening or arbitrating the market. Creating credibly neutral oracle or solver networks is more tractable than creating a credibly neutral dispute resolution mechanism, which is inherently more subjective than prices, slippage, or profit-share.