Liquidity Will Find a Way

How Paycrest is programming the WhatsApp economy of informal OTC markets into a global, atomic settlement layer for the post-SWIFT era.

For the last fifty years, we have operated under the assumption that the natural state of global finance is centralized. We assume that to move money from Lagos to London, it must pass through a correspondent bank—a gatekeeper that sits in the middle, hoarding the ledger and charging a toll.

This is a historical anomaly.

Before 1973, global trade was peer-to-peer. It ran on Telex—a messy, decentralized network of teleprinters where banks messaged each other directly. It was inefficient, but it was open. Then came SWIFT. It promised to standardize the chaos, but in doing so, it centralized trust. It replaced a mesh network with a gated club.

For half a century, if you weren’t in the club, you didn’t move money.

Today, that centralization is breaking. The club is shrinking. Driven by a trend euphemistically called “de-risking,” global banks have severed over 20% of their correspondent banking relationships in the last decade. In plain English, they fired their poorest customers once they did the math on compliance costs versus remittance fees. Emerging markets were no longer profitable enough to serve. The cost of this exclusion is staggering; sending $200 to Sub-Saharan Africa still costs an average of 8.78%, according to the latest World Bank data. That is more than double the G20’s target and the highest rate in the world.

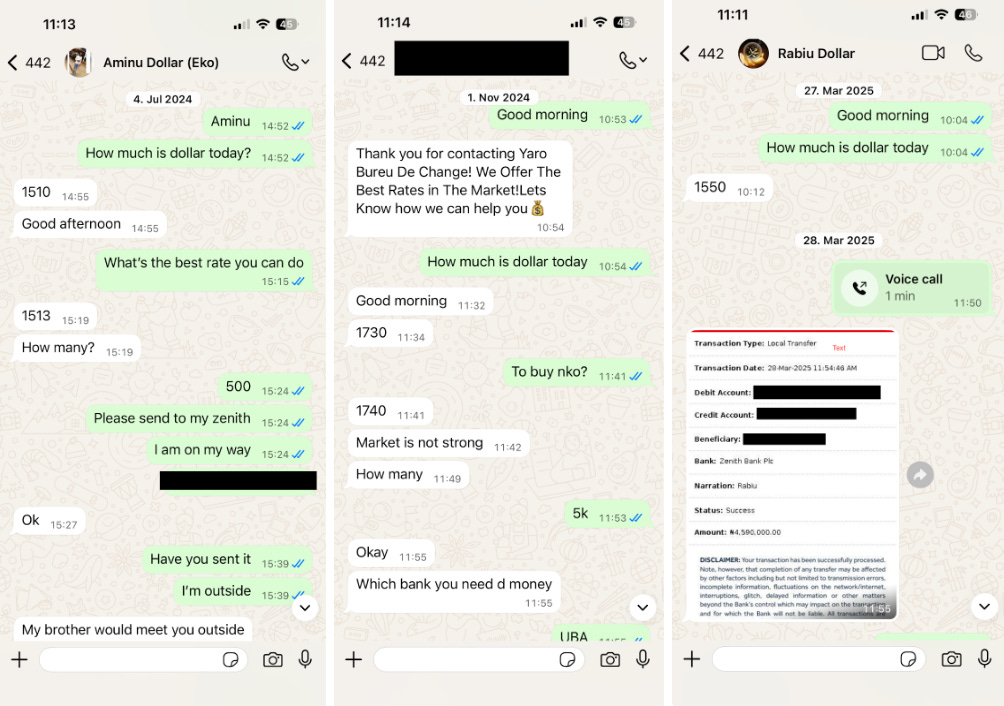

Underneath those numbers is a second, less visible system: “The Shadow Rail”.

The scale of this shadow economy is often obscured, but it would be remiss to ignore it. Considering Africa’s formal remittance volume of nearly $100 billion per year, the money flowing through informal channels is conservatively estimated to be anywhere between $35 to $75 billion on top of that—making it one of the largest financial rails on the continent.

This is a documented reality in some markets like Ethiopia which relies heavily on its diaspora. The Commercial Bank of Ethiopia (CBE) reports that formal channels capture only 22% of the nation’s remittances, meaning the informal market accounts for a staggering 78% of the total flow.

This money moves through OTC dealers running order books out of WhatsApp and Telegram groups, P2P agents with their own mini-treasuries, and local FX desks quietly solving routing for their own networks. On paper, value moves through banks, PSPs, and consumer apps. In practice, a significant share of high-value flows still clears through these grey-area networks because they are faster, cheaper, more flexible, and more responsive to real-world liquidity.

The anatomy of a Shadow Rail transaction

While formal banks rely on “official” rates and hefty spreads to cover their overhead, the Shadow Rail is a ruthlessly competitive marketplace. In a WhatsApp group with hundreds of dealers, liquidity is deep and price discovery is quick.

More liquidity equals tighter spreads: Because these agents are moving large volume daily, they can operate on razor-thin margins that banks cannot touch.

Better rates mean lower all-in-cost: Even if a formal app claims zero fees, they often hide a 3-5% markup in the exchange rate. The Shadow Rail offers a nearest-to-real market rate.

But it is brittle. In the current informal OTC markets, liquidity providers are constrained by trust. An agent can only trade as much volume as their counterparty trusts them not to steal. They must trust that they are solvent, trust that they won’t ghost you after the wire hits, and trust that their bank account won’t get flagged tomorrow.

The market has decentralized liquidity, but it lacks atomic settlement.

Paycrest is the orchestration layer for the WhatsApp economy.

Paycrest is being built by Co-founders Chibie and Francis, both engineers with experience spanning crypto-native infrastructure (ConsenSys, Gitcoin) and high-scale backend systems (Kinship, including payments and high-volume APIs). They’ve chosen to build where the constraints are real—liquidity, trust, and settlement.

Paycrest takes the existing, high-trust networks of local liquidity providers—who currently operate manually with spreadsheets and text messages—and upgrades them into a programmable rail.

Think of it as codifying the social contract.

Today: An OTC agent in Nigeria operates on probabilistic trust. They take a risk every time they pre-fund a trade or send a wire based on a WhatsApp screenshot. Their volume is strictly capped by how many people they trust.

With Paycrest: That same agent operates on deterministic proof. They plug into the protocol, still using their local bank accounts to move liquidity, but the Escrow Layer acts as the trust anchor. They don’t need to trust the counterparty; they just need to check the chain.

By effectively wrapping these informal agents in smart contracts, Paycrest allows them to scale from a contact in a phone book to a node in a global network.

For Paycrest, the WhatsApp OTC market isn’t a broken system to be fixed; it is the natural state of trade re-asserting itself—a decentralized market routing around the artificial barriers of the SWIFT club. Paycrest’s job is not to replace it, but to give it atomic settlement, capital efficiency, and code-enforced trust.

Dead capital vs. Just-in-Time execution

To understand why the current system is failing, and why the Paycrest model is interesting, you don’t have to look any further than the balance sheet.

To facilitate instant payments in Nigeria today, a fintech or traditional bank acts via a Nostro account. They wire $1 million to a local partner in advance, where it sits idle, earning zero yield, exposed to local currency devaluation and counterparty credit risk. This is the “cost of doing business.” It is why fees remain high and liquidity remains thin.

Paycrest harnesses a structural advantage native to stablecoins: Just-in-Time Liquidity.

Because stablecoins settle atomically 24/7, Paycrest eliminates the need for pre-funding. A Liquidity Provider on Paycrest—whether a treasury in Nairobi or an OTC desk in Vietnam—keeps their capital in their own (possibly yield-bearing) accounts until the specific second a trade is executed.

They do not send fiat to the protocol. They only automatically execute a payout when there is a funded, escrowed order on-chain.

This unlocks massive capital efficiency. It transforms “dead” capital into “live” potentially yield-bearing assets, allowing providers to quote tighter spreads than incumbent banks who are weighed down by the cost of idle float.

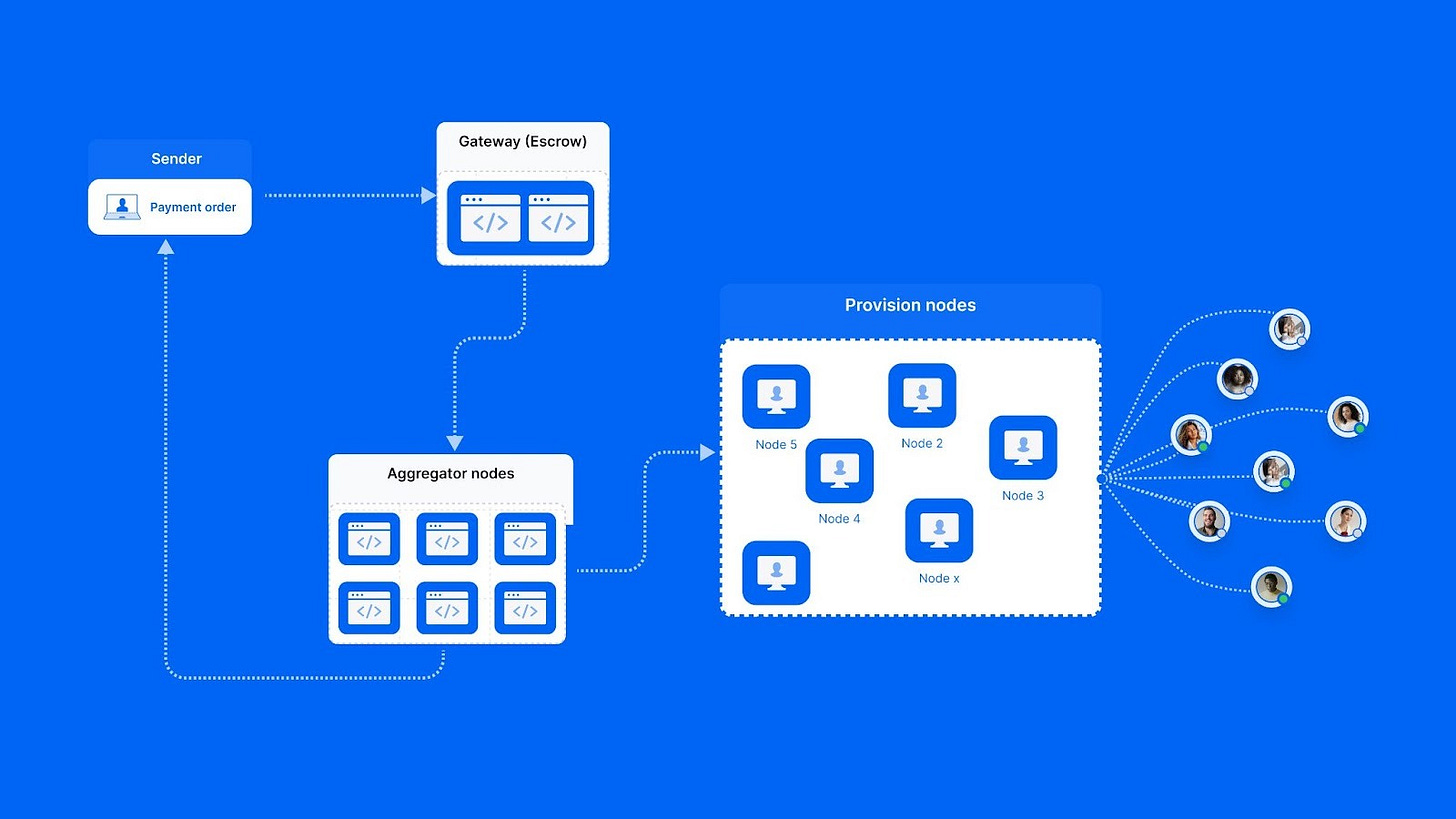

Paycrest unbundles the role of the bank into three distinct, programmable layers. It is a routing daemon that lives on the blockchain.

The Escrow Layer (Trust): A Sender (e.g., a payroll app) locks stablecoins into the Paycrest Gateway smart contract. This replaces the “credit risk” of the Telex era with cryptographic certainty. The provider knows the money is there because they can verify it on-chain.

The Routing Layer (Intelligence): An Aggregator node scans the network for verified providers. It matches the order not just on price, but on reliability and speed, routing around outages in real-time.

The Settlement Layer (Finality): A Provider node executes the fiat payout via the connected local banking rails. Once a cryptographic proof of payment is submitted, the smart contract releases the stablecoins.

This architecture achieves Zero Counterparty Risk at the routing layer. The protocol never takes custody. The Sender never loses custody until the fiat is delivered. The Provider never releases cash until the crypto is locked. A trustless swap engine for the world’s fiat currencies. For a deeper treatment of trust trade offs, see What is Trust Worth?

This is what Chibie, one of the founders, means when he says “it’s not ‘don’t be evil’; it’s ‘cannot be evil.’” The design eliminates protocol-level counterparty risk rather than promising good behaviour.

Proof of work: Noblocks and the street price

The theory is sound, but the streets demand proof. The team is validating the thesis with two pieces of software that attack the friction of the informal market: Noblocks and the Noblocks Rates App.

1. The Execution Engine: Noblocks

The scale at which a protocol succeeds is orders of magnitude above the scale at which an app succeeds. Paycrest is a protocol, but protocols don’t take off by themselves. They need a playbook.

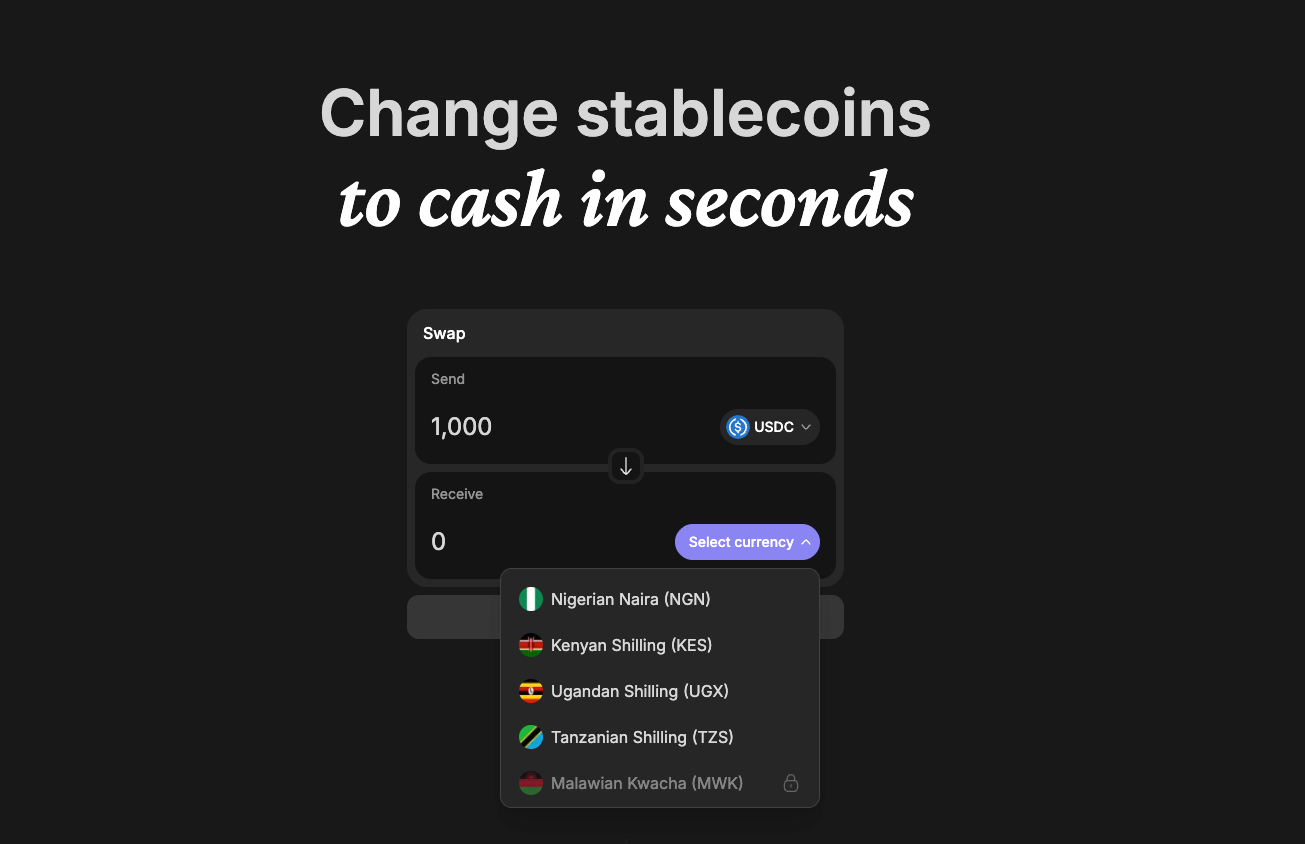

The team’s strategic answer to this GTM challenge is Noblocks, an open-source reference implementation built entirely on the public Paycrest protocol.

Prior to Noblocks, it was difficult for people to really “get” Paycrest. The protocol was too abstract. Noblocks functions as a showroom and volume driver—it proves the technical possibility and drives the volume required to stress-test the rails. Though other apps are built on Paycrest, Noblocks currently drives the majority of the volume, acting as the necessary catalyst for adoption.

It serves as a live blueprint for any developer to see exactly how to build on top of the rail.

Noblocks stripped away the dashboard, the wallet balance, and the complex sign-up flows of traditional remittance apps. It proved that if you solve the routing and liquidity problem, the user experience can become delightful.

When the team released a recording of a MetaMask transaction settling into a Nigerian bank account in seconds, the viral response was immediate proof of what users really cared about—rates, reliability, and speed.

Critically, Noblocks is fee-free for consumers. The revenue model is entirely at the protocol level (a ~0.5% fee charged to the provider side). This strategic choice turns Noblocks into a pure volume driver, stress-testing the protocol’s capacity. As of today, it has quietly processed over $2 million in volume, serving as the reference implementation for the 30 active business senders currently integrating the API.

It handles the complexity so the user doesn’t have to, and does this via:

Gasless Transactions: Users don’t need ETH or MATIC for gas; they just sign and send.

Compliance Shield: Integrated with tools like Shield3, it screens wallets for OFAC sanctions instantly.

2. The Truth Machine: Noblocks Rates App

If Noblocks is the engine, the Noblocks Rates App is the dashboard.

In the traditional “WhatsApp Economy,” FX rates are opaque. A trader in Lagos might quote 1,500 NGN/USD while a desk in London quotes 1,480. The spread is pure friction. The Rates App acts as a real-time, public ticker for the protocol’s liquidity. It aggregates quotes from the decentralized network of KYB-verified providers, offering a “mid-market” rate that is often tighter than formal fintechs.

For the User: It provides the transparency of a Bloomberg terminal with the execution of a street trade.

For the Provider: It creates a competitive marketplace. To win volume on the Noblocks front-end, providers must tighten their spreads, driving the entire network toward efficiency.

This seemingly simple tool validates Paycrest’s core hypothesis: if you provide a transparent routing layer, local liquidity providers will compete to compress the cost of remittance.

Compliance at the edges

The lazy critique of decentralized rails is that they are incompatible with anti-money laundering (AML) laws. Regulators demand to know who is moving money.

Paycrest’s answer is a proposed design philosophy known as Aggregated Compliance.

Rather than centralizing sensitive user data in a global honeypot—which creates a single point of failure and liability—Paycrest is building the infrastructure to push compliance to the edges, where the fiat actually touches the banking system.

The Aggregator verifies the KYB status of the Provider.

The Sender captures KYC on the end-user.

The Protocol coordinates the transaction.

By using Verifiable Credentials and Proxy Re-encryption, the goal is to ensure that identity data travels with the transaction but remains accessible only to the specific Provider fulfilling the trade. This satisfies the local regulator without forcing the protocol itself to become an instrument of surveillance. It is a subtle but profound shift: enabling compliance without centralizing control.

Why this matters now

We are at a unique convergence point in financial history. What makes Paycrest interesting is that it aligns with three macro shifts happening in parallel:

Stablecoins are becoming a de-facto settlement asset: Stablecoins clearly have product-market fit as dollar proxies in emerging markets, but the bridge into and out of local fiat is still a patchwork of exchanges, P2P chats, and single-point-of-failure fintechs. The onchain economy has achieved escape velocity. Stablecoins settled an estimated $27.6 trillion in 2024, effectively flipping the combined transaction volume of Visa and Mastercard.

Global regulators are explicitly targeting cross-border payments. The G20 has made cost, speed, transparency, and access in cross-border payments a formal policy target, and current systems are still far from those goals—especially in Africa.

Africa’s “shadow” liquidity is digitizing. From OTC desks to local stablecoin issuers, more of the real economic action is happening off the balance sheets of traditional banks and onto programmable, API-driven rails. Market mapping of Africa’s stablecoin payments ecosystem puts Paycrest in a small cluster of teams building the underlying plumbing rather than just the apps.

For years, the narrative has been “formalize the informal sector.” But liquidity continues to flow through informal channels because they optimize for what people need—speed reliability, and human trust. Paycrest treats that behaviour as infrastructure—and uprgades the settlement layer beneath it.

The convergence creates a narrow window: Regulators are increasingly hostile to centralized exchanges but have not yet fully grokked protocol-level infra. This provides a limited opportunity where a credibly neutral, compliance-aware routing layer can be adopted by banks, PSPs and crypto apps before existing players ossify into de-facto gatekeepers of stablecoin FX.

The founders aren’t trying to build a better remittance app or replace the WhatsApp economy. They are trying to finish what Telex started: a global, peer-to-peer financial network that no single entity can control, and no single failure can stop.

There is more to build (and validate) at scale

Elegant design does not eliminate execution risks. There are hard questions Paycrest must answer:

Aggregator incentives: Currently, Paycrest runs the primary aggregator in a “federated” model. Transitioning to a fully permissionless network—where third parties run aggregators for profit—requires solving complex mechanism design challenges regarding fees and incentives. The trigger for this transition remains undefined

Liquidity Cold start: To win, Paycrest must offer better rates than Binance P2P or local black markets. This requires massive volume to attract market makers, but market makers won’t come without volumes.

Regulatory whack-a-mole at the edges: While the protocol is neutral, the edges (bank accounts) are vulnerable. If a regulator aggressively de-banks the providers in a specific corridor, liquidity vanishes. The protocol is censorship-resistant; the local banking system is not.

These are non-trivial problems. Yet they are precisely the set of problems that, if solved by the team, create a global financial primitive. Paycrest is a bet that the future of money isn’t just about minting tokens; it’s about making that money spendable, anywhere, instantly, without asking for permission.

You won’t “use” Paycrest any more than you “use” TCP/IP. You will simply send dollars, and they will arrive as Naira, Pesos, or Shillings and the friction of the last mile—the 8.78% tax on the global poor—will finally disappear.