Jia: Bringing Onchain Capital to SMEs

Announcing top submissions to LAVA's Master of Narratives

Over 60 people applied for our Master of Narratives role, where instead of CVs and cover letters, we asked them to do the real work. Pick any Web3 startup operating in Africa and answer a question:

“Why does it matter?”

We received submissions, mostly written but some videos, from across the continent and beyond. Over four months, we went back and forth with candidates—emails, calls, and rewrites.

Today, we’re sharing the second of three winners: Imani, who is a engineer by day and writer by night, took a detour from his usual "stablecoins, bitcoin, and defi in Africa" to write "Jia: Bringing Onchain Capital to SMEs."

Imani tackled a startup we were aware of but never dove into. Especially of note is how he meticulously thought around comparing Jia to other fintech co's, banks, and onchain lenders, then communicates that through clear writing. His piece stirred up our curiosity about the uncanny boundary between on and offchain credit and left us wanting more.

Jia: Bringing Onchain Capital to SMEs

SME Financing in Africa

Across Dar es Salaam, you’ll find dozens of open markets bustling with countless vendors - mostly women - selling fresh fruit and vegetables. Arrive too early or too late, and their shelves are often bare. Many can only afford to buy stock one day at a time - their supply begins when their supplier arrives not when demand does.

A business can only grow as far as its balance sheet allows. If these vendors had a small line of credit they could purchase inventory for the full week, make more sales, and potentially expand. When you zoom out you find that this is a common story for SMEs in Africa.

These SMEs make up 95% of enterprises in Africa and account for 50% of the continent’s GDP, yet face a shortage of over $500 billion in financing. The capital that is available is expensive and often tied to strict collateral obligations. Those who do secure funding frequently find themselves in a debt trap - often leaving them in a worse position than before.

Jia

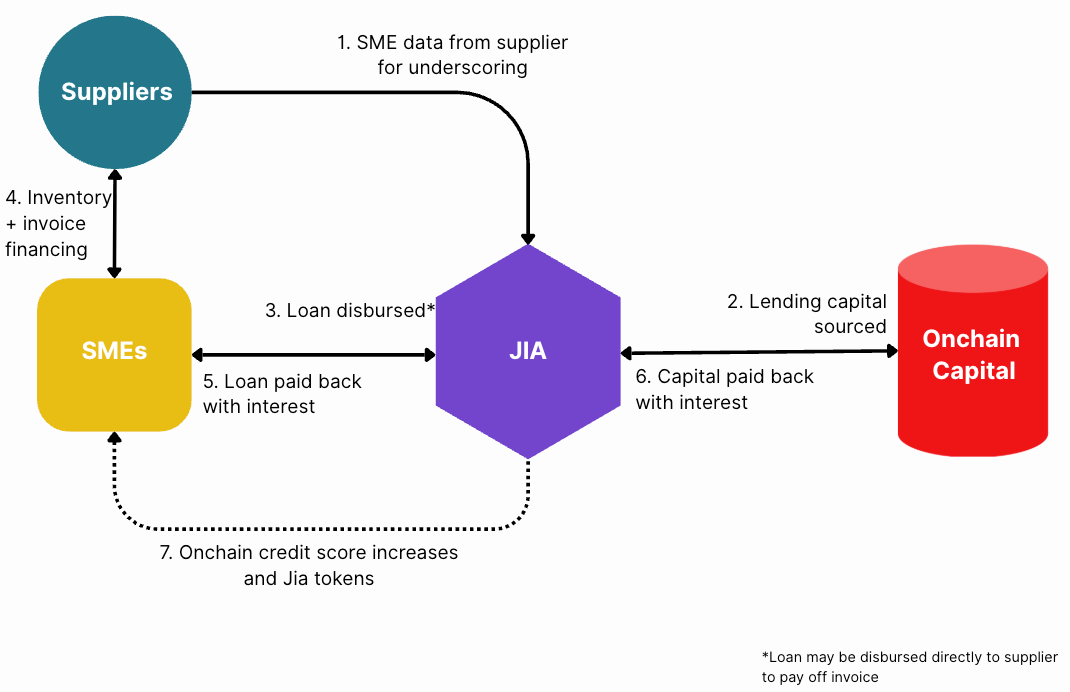

Jia was created to solve this exact problem, providing small businesses in emerging markets access to capital. The way it works is: on one end Jia partners with suppliers to source data on the SMEs they sell to - this includes but is not limited to data from PoS and inventory management software - which is then analyzed to evaluate credit worthiness. On the other end, Jia sources capital from various onchain lending pools.

Borrowers use this capital to pay off invoices or acquire inventory. When a borrower repays their loan, they are rewarded with JIA tokens, which serve several purposes:

They can be used to unlock rewards such as lower interest rate or larger loan amounts.

They onboard borrowers into the web3 world.

For Jia, these tokens serve as an incentive for timely repayments and help drive user retention.

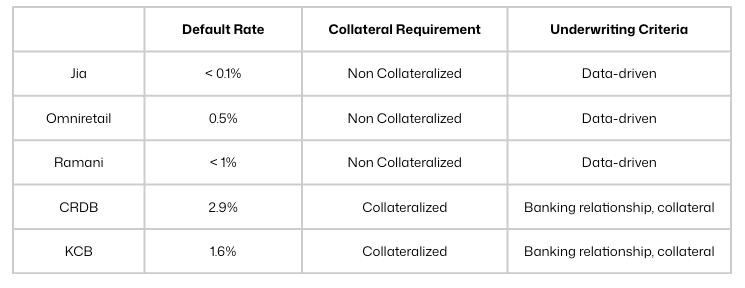

Jia’s data-driven method of underwriting businesses has enabled an incredible default rate of less than 0.1%, with over $12 million in loans disbursed from onchain credit protocols. Fintech lenders, who’ve deployed a similar methodology, like Ramani in Tanzania and OmniRetail in Nigeria have both had great success as well.

Why Banks Struggle to Lend to SMEs

You might be wondering, if this works so well then why don’t banks do it?

It’s safer to lend to the government and large enterprises. Banks can lend in large volumes to the government by purchasing bonds or to large enterprises, and have the peace of mind that they’ll be paid back on time. The smaller the borrower, the higher the risk.

One size fits all models. African banks often assess the credit worthiness of SMEs using the same framework they apply to large businesses. With limited information to evaluate an SME, banks default to issuing collateralized loans at high interest rates - essentially pricing in the risk.

Access to data. Fintechs like Ramani spent years building out infrastructure to collect and analyse data, such as object detection software layered on top of CCTV to accurately track inventory. Banks generally don’t have the expertise to build out such infrastructure.

Without banks, there is limited capital available to SMEs. For fintechs there’s a puzzle around where to efficiently source capital. Ramani and OmniRetail have managed to partner with banks, but the lengthy process has limited them to only a handful of relationships.

By sourcing capital onchain, Jia is able to tap into yield seeking global liquidity pools; unlocking capital at scale. Unlike banks, this capital comes with a few advantages:

Fast disbursement. No slow bank transfers or currency restrictions.

Scalable and programmable. Lending vehicles are enforced by auditable smart contracts, making it straightforward to connect with additional onchain lenders.

Protected from local currency risk. Borrowers can hold funds as USD stablecoins, shielding them from local currency devaluation.

Why Other Onchain Lenders Have Struggled

What Jia is doing isn’t necessarily new, but onchain lenders have found it incredibly difficult to build successful business models.

Goldfinch, for example, which originated over $100 million in loans, saw its default rate rise from near zero to over 10% as it scaled SME financing in emerging markets. This was a result of sub-par underwriting as well as scaling too fast.

DeFi can enable trustworthy coordination among independent parties, but using these rails to sidestep traditional underwriting doesn’t work in markets where reliable public borrower data is scarce.

Goldfinch made this mistake, opting to rely on third parties for sourcing, and liquidity pool participants for consensus on decisions. This model was scaled rapidly across markets in Africa and South-East Asia. What resulted was three major defaults from loans to intermediaries lending across Kenya, India, Indonesia, and the Philippines.

How you scale credit matters. Both the timing as well as scaling vertically vs horizontally.

Jia has robust data pipelines and boots on the ground in the two markets - Kenya and Philippines - it currently operates in. When they raised a $4.3 million seed round two years ago the focus was to double down on these markets rather than expand.

Looking Forward

The convergence of Africa’s growing SME sector and global onchain liquidity will play a key part not only in Africa’s long term economic growth, but also in creating value within the global crypto industry. Crypto provides the capital, SMEs provide the yield - aligning incentives on both sides. Jia is slowly becoming a leader in this space, and it will be exciting to see how they scale long term.